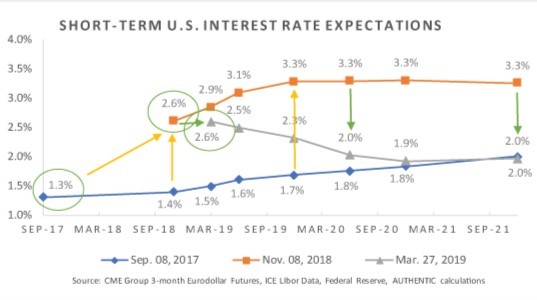

Embracing FOMO & TINA

Synchronized global central bank & fiscal policy stimulus in Q2 was breathtaking. Near term, it is stunting the carnage caused by Covid-19, including economic growth plunging at a rate not seen since the Great Depression. It is also an affirmation of the jaw-dropping power of printing money and the impact across asset markets, both explicitly, […]

Read more >